Markets are wrestling with the question as to which is the greater risk; Inflation…or recession?

For Maven’s counterparts, part of the answer rests on the speed, magnitude and destination of central bank rate hikes and in this context, the next U.S. CPI (inflation) release on 13th July is key.

This isn’t surprising given that the previous “hot” print for May, published on 10th June, roiled markets globally and when coupled with tight labour markets, Taylor Rule estimates were revised, and yields spiked.

Up until that point, the flows we’d enabled had reflected a more sanguine view, as some of the bearishness in rates markets had started to recede. This dovishness coincided with “buy-on-the-dip” market commentary and as the sentiment improved further, we heard a lot of speculation around CTA trigger points and portfolio reweighting flows; this optimism proved to be short-lived, however.

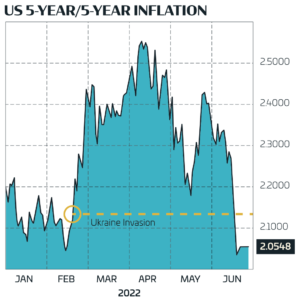

On balance, our counterparts believe the Federal Reserve is more concerned about inflation than the downside risks to growth. This determination is reflected clearly in the sharp pull-back in forward inflation, which has now retraced the entire move linked to the Ukraine invasion and associated sanctions, as the prospects for a global recession start to increase.

We held many discussions around the reset in bond yields fuelling equity risk and there were suggestions we were witnessing a structural regime change in market volatility. This relationship led to concerns around explicit and shadow leverage in the risk-parity space, with the observation that portfolio stress was building.

The principal concern was the positive correlation across assets, and specifically whilst constituent volatility was below pandemic levels the correlation was higher which meant that the blend for portfolios was becoming increasingly uncomfortable.

Increased volatility together with challenging liquidity has led to some resizing and reshaping of trades. In European rates, we have seen more spreads and ratios to dampen the initial premium and more rolling of positions given the pronounced spot moves. We have also seen an increase in both far-left and far-right tail hedging, however, the overall conviction remains low. The perception of previously crowded short positioning, notably in ten-year Bunds has started to reverse, and we have seen speculation and positioning for a potential switch in the CTD (Bond which is Cheapest to Deliver) which added further upward pressure to the already stubbornly high levels of implied volatility.

In equities, we’ve seen fewer call overwriting requests, because whilst higher implied volatility means the harvestable income has increased, the view is that it still represents insufficient compensation given the clear risk of sharp bear-market rallies.

The volatility has affected regional equity indices in different ways and in combination with other idiosyncratic factors, we have seen a large increase in flows away from the “major” benchmarks. For example, we saw a pick-up in CAC Index requests ahead of the French elections which coincided with the basis of Bunds to OAT’s pushing out to pandemic levels; we also saw an increase in volumes in FTSE index options given its defensive characteristics from high energy and financial sector weights.

Similarly, we have also seen a pick-up in FTSE MIB requests to express concerns around fragmentation & periphery risk in general. This has coincided with an increase in BTP interests and developments around the implementation of the ECB’s anti-fragmentation tool are also keenly monitored.

Most recently, we have seen strong interest in short-dated DAX Index hedges stemming from Germany’s reliance on Russian energy and impending Nord Stream 1 maintenance works, scheduled to start next week.

This overall dispersion has been a feature both within and across indices, as well as Sovereign bonds. Without a doubt, market participants are becoming more vocal about recession fears, and this is clearly visible from the flows which have driven yield curve inversion in the U.K. and U.S. with Europe not far behind.

Our most frequent discussion was skew differentials between Euro Stoxx & SPX, with the latter shifting from multi-year highs to multi-year lows. There has been a wide range of explanations including monetisation of existing hedges, structured products and large vanilla positions contributing to the spot-down/vol-down dynamic as well as the intra-day performance of the Index versus its close-to-close measurements.

Following the main options expiry plus month/quarter/H1 end, the view now seems to be that the potency of these dynamics is waning and may reverse, for now we often hear how skew and regional spread positions are challenging to manage as the variability in spot-vol dynamics is further complicating trades.

Maven’s counterparts are on high alert ahead of the Q2 earnings season starting in two weeks, especially after the extent of the tech sector’s weakness revealed in April’s announcements.

There is no doubt that higher input prices have created headwinds for corporate profitability and there is significant interest to see average growth rates once the energy sector and its effects are stripped out. This aligns with a broader shift in focus to the credit space, particularly High-Yield and Junk where once again stress is clear, and we’ve seen a resultant increase in Treasury & Bund hedges as proxies with better liquidity.

As we take our first steps into the second half of the year, rate expectations are pulling back as growth worries mount. Whether inflation or recession proves the greater risk, we stand firm in our commitment to support the markets and provide consistent and dependable liquidity to our counterparts across our global products.